Governor of the Bank of Ghana has downplayed projections from London based Economists Intelligence Unit (EIU) that the Ghana cedi could witness another round of serious depreciation in the coming months.

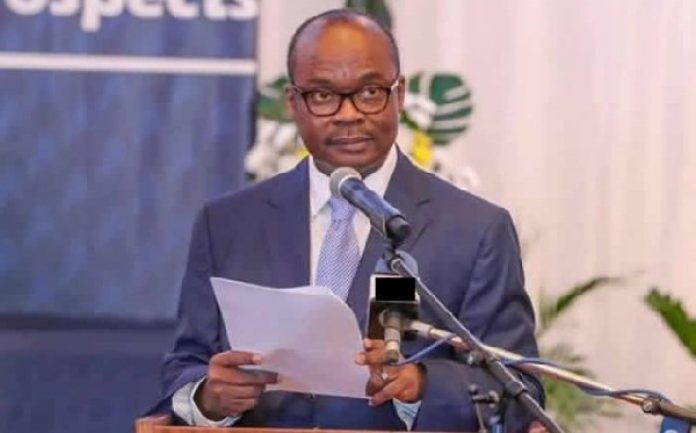

Dr. Ernest Addison said, “I don’t think that these projections are plausible especially to be able to project the exchange rate for three years that is really a daring thing to do and you will find that such projections more often than not do not turn out to be correct because the horizon is too far out.

He added, “But I can tell you that our objective is to keep the cedi as stable we can and also keep our inflation on target. We should expect that the cedi would remain stable over the short to medium term on the basis of that fact that we are currently fairly well positioned in terms of the level of international reserves we have.”

The Governor was speaking at the Monetary Policy Committee’s Meeting press conference which announced the central bank’s decision to hold the policy rate at 16 per cent.

The Economist Intelligence Unit (EIU) has predicted that the Ghana Cedi will hit GH¢6.50 to US$1 by 2023.

This was contained in EIU’s country report on Ghana which was released on 13 May 2019.

In his briefing notes, the editor of the EIU report, Nathan Hayes, stated that: “The cedi will remain prone to periods of volatility, given the ongoing domestic economic weakness of high dependence on commodity prices. From an average of GH¢4.58: US$1 in 2018, the currency will weaken to GH¢6.50: $1 in 2023”.

The EIU said it now expects the cedi to average GH¢5.31 to $1 in 2019, from GH¢5.20 to US$1 previously, with depreciation driven by the government’s fiscal position, together with the large current account deficit and increased political uncertainty before the 2020 elections.

“We have revised down our inflation forecast for 2019, to 9.6% from 10.9% previously, as the broader downward trend in inflation from its 2016 highs continues and as the higher base effects from 2018 temper the growth rate more than we previously envisaged,” the report added.