The National Board for Small Scale Industries (NBSSI) says one of the challenges it has faced since commencing distribution of the stimulus package under the Coronavirus Alleviation Programme (CAP) business support scheme is complaints of funds’ shortfalls.

According to the NBSSI, a quick investigation into the complaints revealed that the beneficiaries were yet to service loans they accessed from their Mobile Money (MoMo) operators, resulting in the shortfalls. As a result, the NBBSI is asking all applicants to ensure that they service their loans from mobile money operators before the monies applied for hit their mobile money accounts.

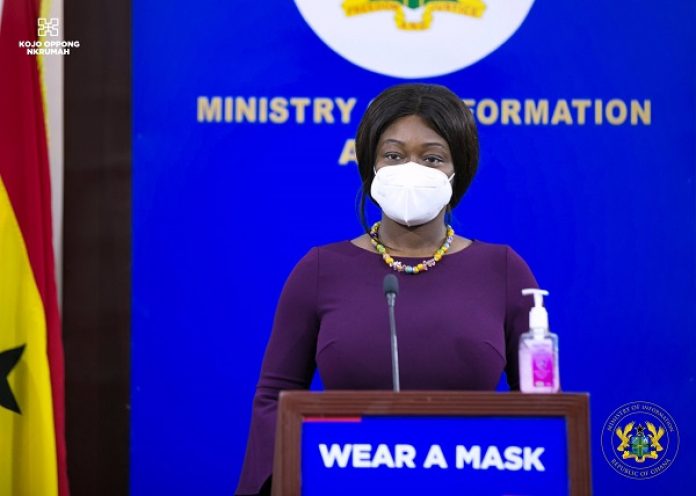

“We have been receiving reports on the disbursement and are working on it. That is why I said that if somebody has a MoMo debt and you don’t settle it and the money comes and it doesn’t add up; please remember that they have deducted it. Please ensure that your account is clean, especially if you put in a MoMo number that has debt on it,” said the Executive Director of NBSSI, Kosi Yankey-Aryeh.

As part of the disbursement model, Mobile Money accounts were used to send monies to some MSMEs which had no bank accounts or preferred MoMo. On the state of disbursement, Mrs. Yankey-Aryeh said the funds were meticulously allocated to cover all regions, sectors and associations across the country.

“We made sure that every region benefits from the first tranche. We did this by percentage allocation. We looked at the regional breakdown, and after that looked at the sectors and then the associations,” Mrs. Yankey-Aryeh said.

For now, the NBSSI has halted any further application after it gave a grace period for when the initial deadline ended. The NBSSI announced a six-day extension of the application deadline to allow MSMEs that were yet to complete their applications to do so – which ended last Friday, June 26, 2020.

According to Mrs. Yankey-Ayeh, the grace period gave the CAP Team opportunity to rectify all technical issues, including applicants with wrong credentials on the system. This, she said, was to help mop-up all paper applications that were yet to be entered into the system.

She explained that through the NBSSI’s Business Advisory Centres in 180 districts across the country, the board had also supported some businesses and trade associations whose members had challenges completing applications on the digitised application portal.

For her, the data be derived from this process will go a long way to change the face of dealing with MSMEs in the country, as state and financial institutions will have a better understanding of their numbers and how they are spread across the country, their challenges, and how to create products to target them.

Source: B&FT Online